A Comprehensive Guide to the Best Home Security Systems DIY Home Security Systems

Meghan Shaw

November 22, 2022

Vivint is an alarm company for homes and specialises in residential alarms. Its products are designed to meet the needs of all kinds of individuals from night owls to pet owners. There are numerous options for customers to pick from. To determine the Vivint security product that is best for you check out the following article!

The types of Home Security Systems

There are many kinds of home security system that are available today. The most well-known kind is the wired that utilizes a system of cameras and sensors to keep an eye on your home. Wireless systems are becoming increasingly well-known, since they are easier to set up and can be operated remotely.

There are many different home security systems available. Not all are made equal However, they all have their own unique. Certain models have more options than others, and it’s crucial to evaluate various brands to find the one that’s best suited to your requirements. Here are a few of the most sought-after security systems for homes currently:

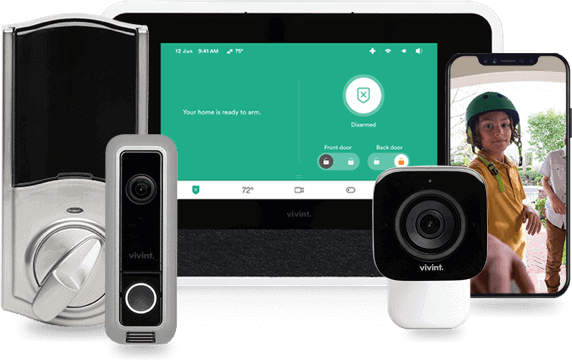

1. Vivint Security Home Security System: This system includes a wide range of options, such as sensors for windows and doors as well as motion detectors as well as wireless cameras. It also includes an app for mobile devices that lets users to arm or disable the system from a distance.

2. ADT Security System for Home Security System: ADT is one of the most popular names in the field of home security. The systems it offers include window and door sensors as well as motion detection along with wireless cameras. It is also possible to add other services such as security monitoring for the home and environmental control.

3. SimpliSafe home Security System: SimpliSafe offers an affordable solution to those seeking the most basic security features for their home. The system comes with sensors for windows and doors along with motion detectors and a base station that has siren. Upgrades can be made to include things like wireless cameras and professionals monitoring.

4. Nest Secure Home Security Systems The Nest Secure system comes with window and door sensors motion detectors,

Best Types of Home Security Systems

There are several kinds of home security systems that are available which can make it difficult to choose which is the best one the best for you and your property. Here’s a brief review of the various types of home security systems that can assist you in making a choice:

1. Wireless Home Security Systems: Security systems for homes that are wireless are getting more popular because they are simple to install and do not require complicated wiring. They connect to the control panel through radio frequency signals, and are usually extremely reliable. A majority of Wireless home security alarms are equipped with sensors that are able to be placed on the outside of your house along with windows and doors.

2. The hardwired Home Security Systems: Hardwired security systems for homes are more reliable than wireless ones, since they require wiring to connected throughout your house. While this may be more labor-intensive and costly to set up, they are generally much more durable than wireless systems. The majority of home security systems that are hardwired have intrusion detectors which can detect when someone has broken into your house, as well being motion detectors which can notify you when there is movement in your home, when they shouldn’t.

3. Smart Home Security Systems: Smart home security systems are the most recent kind of security system available on the market today, and they come with a wide range of options that other systems do not offer. Certain smart home security features include the capability to manage your system through an app for your tablet or smartphone as well as receive real-time alerts when there’s activity in your property.

The best home security systems to meet your family’s security requirements

Vivint security systems for homes are among the most well-known in the market and with the reason that they are. They provide a variety of features that can meet any family’s needs. They’re also easy to set up and operate. Here’s a list of the most effective Vivint security systems for homes and families:

Vivint Smart Home Security System Vivint Smart Home Security system is among the most extensive available on the market and is perfect for homes that are larger. It offers features like 24-hour monitoring dual-directional audio and mobile application control, and much more. It’s also easy to grow when your family’s needs change.

This Vivint Smart Home Security Camera ideal for families who need an additional layer of security. It provides HD video quality security cameras for night, motion-detection and much more. Additionally, it can be used in conjunction to other Vivint products to give you even greater security.

If you’re looking for a economical alternative then this Vivint Essential Home Security System is a good option. It has all of the features of that of the Vivint Smart Home Security System but with a more simple appearance. There are also no monthly costs!

If you’re searching for basic home security then the Vivint Doorbell Camera is a good choice. It provides live streaming as well as two-way audio and motion detection alerts and much more. All without cost-per-month!

Installation of a DIY security alarm system

Installing a security system for your home is a difficult undertaking, but with proper instructions, it’s an easy task. There are a few points to consider when installing your home security system.

1. Pick the best spot of your control panel. The control panel acts as the brain for your security systems, therefore it is crucial to select an area that is central and is out of the access of burglars.

2. Create the layout for your devices and sensors. Once you’ve determined the location where your control panel will be, you are able to begin to plan the design of your devices and sensors. It’s crucial to design an exhaustive plan of coverage that covers every entrance and window.

3. Follow the steps carefully. In the process of installing security systems, it is important to follow the steps attentively. In this way, you can ensure the system is correctly installed and operates correctly.

4. Check your system frequently. Once you have installed your system It is crucial to check it on a regular basis to ensure it’s operating correctly. This will provide you with peace of mind, and also help to identify any problems before they become major issues.

The experience I had with Vivint

I’ve been using Vivint house security system for around two years, and I am absolutely thrilled with it. It is extremely user-friendly and the customer support is exceptional. I would highly endorse Vivint to anyone who is looking for an excellent diy home security solution.

I initially chose Vivint due to the excellent reviews I read on the internet. I was not dissatisfied! The system is easy to use and the customer support is outstanding. I’ve never experienced any issues with false alarms , or any other issues like that. Overall, I’m thrilled about my choice to choose Vivint.

Conclusion

If you’re searching for an alarm system for your home that can give you peace of peace of mind, Vivint is a excellent choice. They provide a variety of products and services that satisfy your needs. Additionally, their prices are extremely affordable. With Vivint you can be at ease knowing that your house is safe and safe.